The first real-world asset blockchain driven by a DAO

Our mission at LEA

At LEA, we believe in democratizing investment opportunities by removing barriers to funding and enabling global participation in high-impact projects. Our goal is to create a decentralized financial ecosystem where anyone can invest, stake, and govern real-world projects without intermediaries.

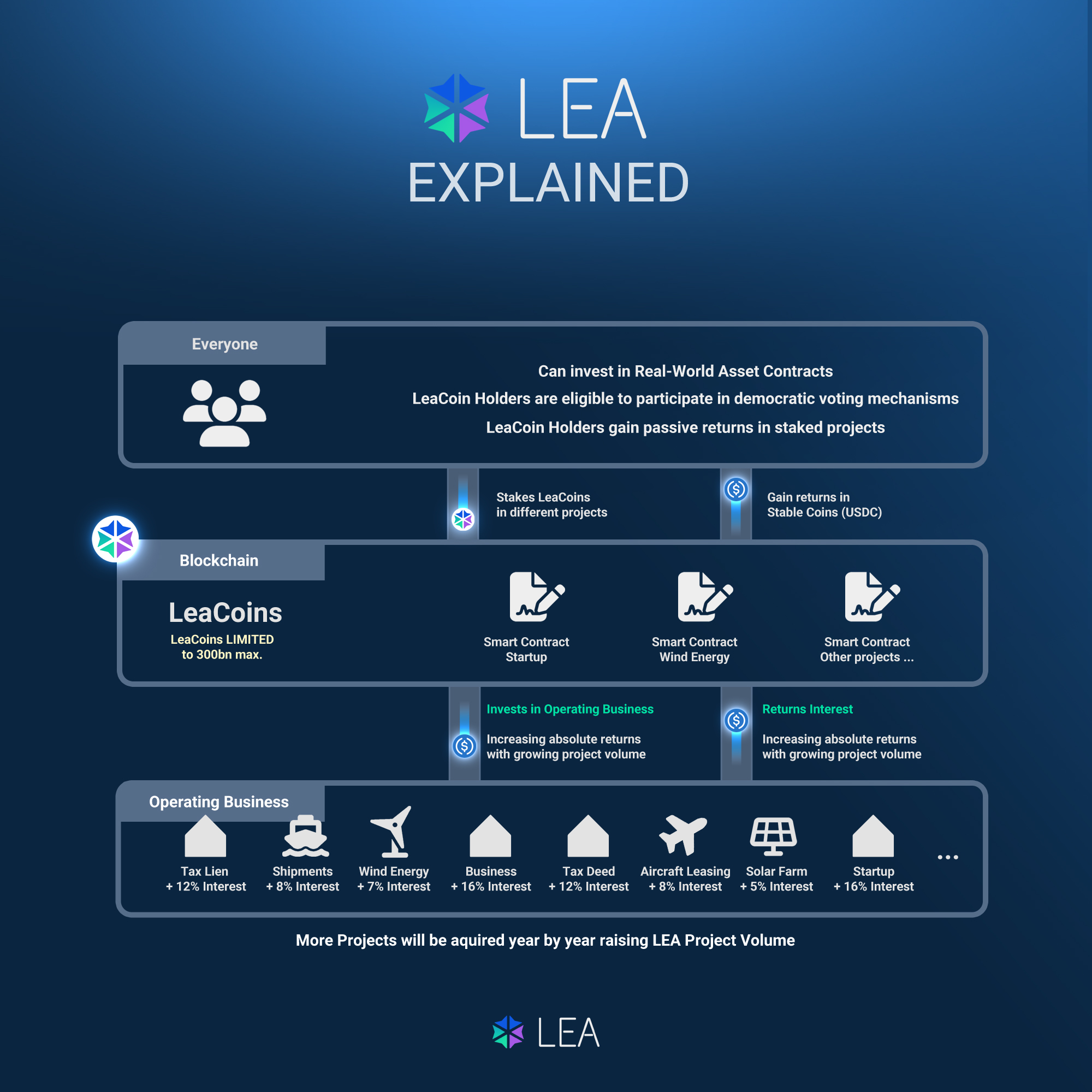

How LEA works

Fund raising and investments for everyone

LEA simplifies real-world asset investment through blockchain-powered funding, staking, and governance. Project owners raise capital, investors stake tokens for rewards, and the community votes on funding decisions—all within a secure, transparent, and decentralized ecosystem.

Project Owners Raise Capital

Entrepreneurs and businesses list their real-world asset projects on the LEA platform.

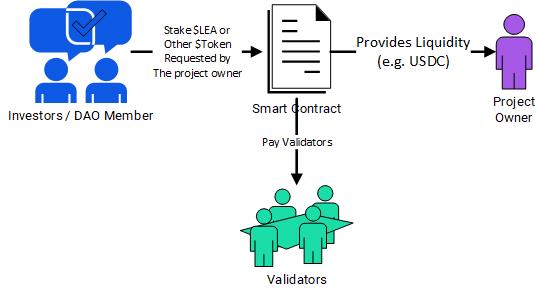

Investors & Stakers Fund Projects

Users stake their LEA tokens to support projects they believe in, earning rewards over time.

DAO Governance Shapes the Future

The LEA community votes on project approvals, investment strategies, and ecosystem upgrades.

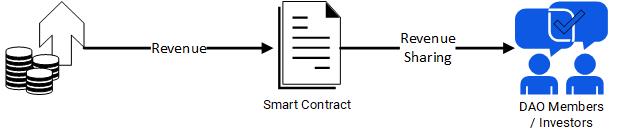

Sustainable Growth for All

Profits are shared, reinvested, and circulated within the LEA ecosystem, ensuring long-term value.

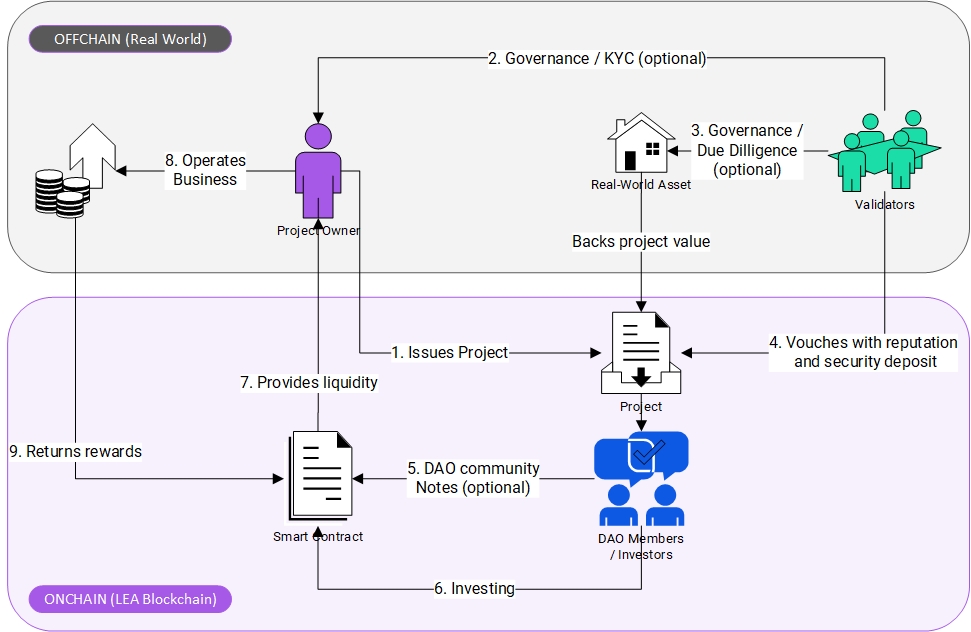

From Real-World Assets to On-Chain Opportunities—All in One Flow.

The Rough Concept: LEA in Action

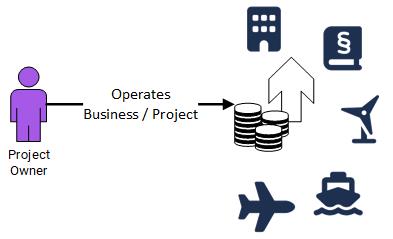

This visual breaks down how LEA seamlessly connects project owners, validators, and investors across both on-chain and off-chain environments. It highlights the decentralized process that turns real-world projects into transparent, community-backed investments with automated revenue sharing.

A clear path from idea to impact

How the LEA Ecosystem Works—Step by Step

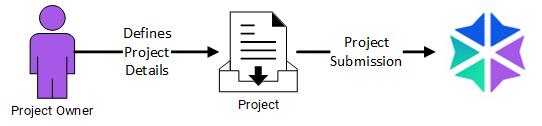

Step 1

Project Submission

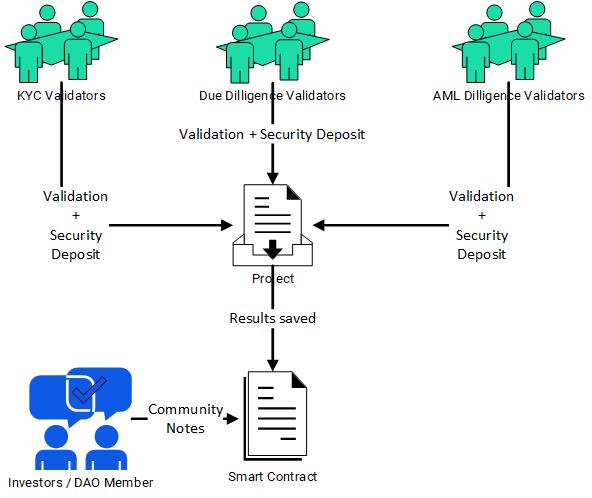

Step 2

Validator Review

(optional) The Project Owner requests validations to build trust in the project. A project may start unvalidated if the Project Owner doesn’t want to build up trust. The DAO Member is able to add Community Notes everytimes to share his opinion about the project.

A network of independent validators steps in to verify the legitimacy of the project. They perform Know Your Customer (KYC) checks, assess submitted documents, and stake their reputation to vouch for credible proposals.

The validator is not liable for project failures that occur later on, as long as the initial validation was conducted correctly.

Step 3

Community Funding

Step 4

Project Execution

Step 5

Revenue Sharing

Join. Participate. Benefit.

Ready to Join the LEA Ecosystem?

Whether you’re here to fund, build, or validate—LEA gives you the tools to take part in a transparent, community-powered economy.